Why Switzerland is one of the leading hubs for sustainable finance and how to support this further

05.12.2022

August Benz | Deputy CEO and Head Private Banking and Asset Management, Swiss Bankers Association (SBA)

Alannah Beer | Sustainable Finance Associate, Swiss Bankers Association (SBA)

This article first appeared at the end of October 2022 in the Journal of Financial Transformation of the renowned Capco Institute.

1. INTRODUCTION

Sustainable finance has attracted a lot of attention in recent years, not least since the last United Nations (U.N.). Climate Change Conference, COP26, in Glasgow. Various financial centers that previously claimed leadership in sustainable finance have done so even more since COP26. They include the U.K., Singapore, and Switzerland, the last of which will be the focus of this article.

This article does not seek to define what is sustainable and what is not. Even in the scientifically advanced field of Paris alignment of financial flows, there is still no general answer to this question. The recent debate in the E.U. about the sustainability of electricity generation from nuclear and gasfired power plants is an example of this. “Sustainability” is a vague, ambiguous, and complex term that can be defined in a number of ways, and it is up to academia and policymakers, rather than financial institutions, to develop a more precise definition. Banks can help raise awareness and provide information on the topic, but they essentially do what the law requires and what their clients demand from them. This article aims to define what is required to become a leading center of sustainable finance and shed light on why Switzerland has a claim to leadership in this area.

2. CHARACTERISTICS OF A LEADING FINANCIAL CENTER

To claim leadership status, a financial center must differentiate itself from other centers in some way. It can do this by offering the most innovative products and services, having a long tradition and/or the greatest expertise in the field, or being the most far-reaching in terms of regulation. Apart from these, however, what are the fundamental requirements for leadership in a specific field?

First, the financial center must have a solid foundation and already be established. This means, among other things, that it already attracts enough clients and assets – both locally and globally – to be internationally and globally competitive and appeal to new clients by offering them a unique selling proposition. This may encompass experience, service, products, and professionalism, typically accompanied by expertise and know-how.

Second, the state, and thus the authorities, need an overarching strategy for taking the lead. This national strategy can be guided by global targets, such as the 17 U.N. Sustainable Development Goals and the Paris Agreement. Crucial to establishing and implementing the national strategy is a properly functioning ecosystem. This requires constructive dialogue and cooperation between the different stakeholders involved. In the case of sustainability, it is about interacting with a wide range of actors from the economy at large, public authorities, politics, NGOs, civil society, and, of course, the financial services industry, which is a driving force in this matter, especially at the national level.

Third, the financial center’s actions must be embedded not only in national strategies but also in the international context and gain recognition and influence in international activities and discussions. Regardless of the strategy chosen, national and international ambitions should not contradict each other, as this leads to greater complexity in an already complex and constantly evolving field. Moreover, a financial center without reach and influence can hardly claim to be a leading hub in a particular field.

3. SWITZERLAND’S CLAIM TO LEADERSHIP IN SUSTAINABLE FINANCE

This article argues that Switzerland has a claim to leadership in sustainable finance because it fulfills the requirements described above.

Switzerland is a globally established financial center and is recognized as such. It is the leader in cross-border private banking, accounting for a quarter of all cross-border assets under management worldwide.1 Despite being a small country and representing no more than around 0.1 percent of global emissions,2 Switzerland has at least an indirect influence on some two to three percent of global emissions in the context of sustainability and in particular combating climate change. This is due to goods imports, the fact that numerous large, multinational corporations have their head office in Switzerland, the country’s important role as a financial and trading center, as well as a production location for innovative, high-tech goods and services.3 These figures imply that Switzerland as a whole, and its financial center in particular, can be pivotal in directing financial flows towards more sustainable economic activities. Some Swiss banks are pioneers in sustainable investments and already have decades of experience in this field.

The Swiss financial center overall has already made good progress in terms of sustainable finance over the past few years and intends to build on this going forward. This is underscored by the growth in this field over recent years. According to the annual Swiss Sustainable Investment Market Study,4 conducted by the Swiss Sustainable Finance in conjunction with the University of Zurich’s Center for Sustainable Finance and Private Wealth, the volume of assets invested sustainably in Switzerland rose from around CHF 41 billion in 2011 to over CHF 1,980 billion in 2021. Sustainable funds account for 53 percent of the total Swiss fund market.

With Switzerland already having an established financial center that has international reach and influence, in June 2020 the Swiss Federal Council released a report on “Sustainability in Switzerland’s financial sector”5 and guidelines6 on sustainability in the financial sector. These guidelines define the objective that the Swiss financial center should be a leading global location for sustainable financial services. This requires framework conditions that allow the Swiss financial center to ensure that its competitiveness is continuously improved and to make an effective contribution to sustainability.

As Switzerland is a small, open economy, with many of its banks and other financial institutions also having cross-border activities and, therefore, already complying with extraterritorial jurisdictions, it is already embedded internationally – at least from an economic viewpoint. It, therefore, does not make sense as a rule to create separate, conflicting regulations. One recent example of the Swiss government taking internationally established criteria and methods into account are the Swiss Climate Scores, launched by the Federal Council in June 2022 to position Switzerland as an international leader in credible climate transparency. These scores consist of six indicators, which the Federal Council recommends that Swiss financial market players apply and disclose. Based on the latest international findings, they provide comparative and meaningful information on the Paris alignment of financial investments by institutional and private investors.7

Switzerland fosters a culture of dialogue on sustainability between many different stakeholders, such as authorities, politicians, NGOs, academics, and various economic actors. For example, the Swiss financial center supports the objectives of the Federal Council and was involved in developing the Swiss Climate Scores. The Swiss Bankers Association (SBA), the umbrella association of banks in Switzerland, and its members have already implemented various measures to support the Swiss strategy and put it into action.

4. CONCRETE ACTIONS TAKEN BY THE SBA TOGETHER WITH THE INDUSTRY

As it wants to establish a leading position in sustainable finance and make an effective contribution towards sustainability, the SBA has actively engaged in various initiatives in recent years. Some focus on the broad concept of sustainability and ESG (environmental, social and governance) criteria, others are more specific to climate. In 2020, for example, the SBA and its members drew up a guideline8 for the integration of ESG considerations into the advisory process for private clients, and in August 2021 it published a joint report9 with Boston Consulting Group (BCG) on “Investment and financing needed for Switzerland to reach net zero by 2050.” In February 2022, it also published a discussion paper10 on climateefficient mortgages.

To take the next step, in March 2022 the SBA and its members released an action plan with specific measures that are now being put into practice:

- Free self-regulation: together with its members, the SBA issued two sets of binding guidelines in June 2022 stipulating minimum requirements for integrating sustainability criteria into investment and mortgage advice. The first governs the integration of ESG preferences and risks into investment advice and portfolio management,11 while the second encourages mortgage providers giving advice to clients to consider long-term value retention, and consequently the energy efficiency of the building to be financed.12

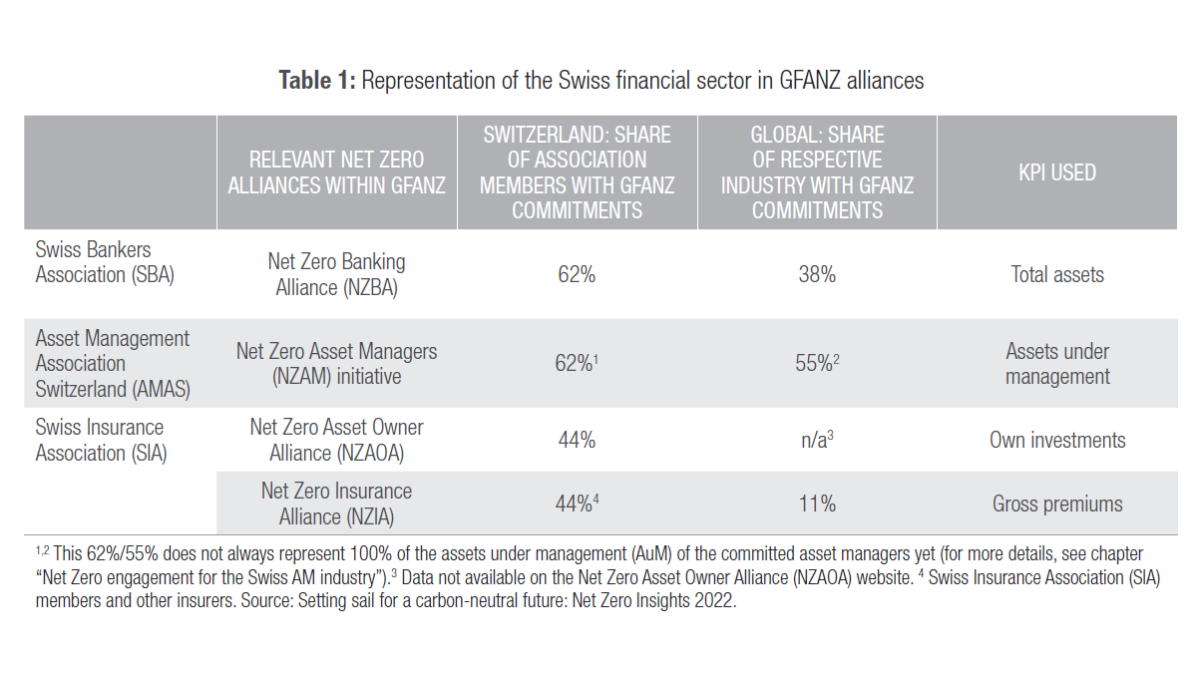

- Net zero initiatives: the SBA regards net zero initiatives as an effective instrument for achieving the climate goals set for 2050 and recommends that its members sign up to international net zero alliances and sustainability initiatives in the banking industry. The SBA itself joined the Net Zero Banking Alliance as a supporting institution in April 2022. In this context, a study was published in August 2022 that analyses the Swiss financial industry’s participation in net zero initiatives. It shows that Switzerland and its banks, asset managers, and insurance companies are among the leaders in terms of committing to them.13

- Education: the SBA and the banks systematically integrate ESG know-how into their education and further training. The SBA has set itself the goal of ensuring that all advisors have a sufficient understanding of ESG issues and apply it successfully in the advisory process with their clients. The two new sets of guidelines also include requirements regarding training and professional development.

The action plan is not only ambitious in its scope, it also entails real adjustments and costs for the banks. For example, advisory processes and staff training as well as professional development must be adapted to meet the newly introduced guidelines. Processes and IT applications also need to be adjusted, and there are further requirements to be met in order to achieve the net zero targets.

5. MOVING INTO THE FUTURE

Although Switzerland is already in an excellent position to claim a leading role in sustainable finance, it needs to do more to build on this and differentiate itself from other financial centers now and in the future.

Digitalization and education are transversal factors that are important enablers for the transition to a more sustainable world and need to be constantly adapted and further developed to unleash their full potential. Education, initial training and professional development, are key to building expertise that can then be applied professionally, for example, to create innovative products and services or advise clients. Digitalization also offers various opportunities, notably the creation of transparency on sustainability-related data.

In terms of transparency, it is crucial to promote the disclosure of targets of sustainability strategies. In doing so, it is important to follow international initiatives and recommendations, such as those of the Task Force on Climate-related Financial Disclosures (TCFD). After all, in a globalized world with international trade, sustainability does not concern individual countries in isolation.

For the sustainable finance ecosystem in Switzerland to be used even more successfully, it must be defined through a broad-based approach to reach as many stakeholders as possible. This will make it possible to identify and address the various needs efficiently and effectively.

Both the national and international dimensions are important for sustainable finance. At the national level, a strong financial center is needed to finance the transition. At the international level, financial centers also need to compete to meet global challenges as well as to foster innovation. It is, therefore, a necessity, and at the same time an opportunity, to steer the financial centers in the right direction.

Being a fast-evolving and dynamic area, the regulatory framework in the field of sustainable finance should allow for competition and room for innovation and, therefore, not be static or only introduce minimum standards. The possibility of such dynamic legal developments is a major advantage of principles-based regulation. In contrast, the typically rulesbased regulation of the E.U. is much less flexible because it only ever regulates down to the smallest details of what is already known, leaving no room for interpretation and further development. It should be possible to take new insights and innovations into account. This is only possible if there is enough scope for adaptation.

6. CONCLUSION

In summary, a leading center of sustainable finance needs an already established foundation, an overarching national strategy on the subject, and to be internationally embedded. Switzerland holds an excellent position in this respect and will strengthen this with future efforts to make an effective contribution to sustainability and position itself as an internationally leading hub for sustainable finance.

In the future, transversal factors such as education and digitalization need to be further promoted and developed to support their potential within the field of sustainable finance. Ecosystems need to be expanded and nurtured, and different dimensions of cooperation need to be considered. Last but not least, the framework conditions must incorporate a certain degree of flexibility to account for new developments, insights, and ideas.

It is worth noting that, while sustainable finance should be understood as an important driver for the transition to a sustainable society, it is not a “magic potion” that can meet the challenge on its own. Investors and clients must decide to direct their capital towards sustainable purposes, and sustainability goals must ultimately be implemented where the actual transition to sustainability can be made. The strategy for achieving a sustainable financial center must, therefore, be embedded into an overarching, all-encompassing strategy, as is the case in Switzerland with its Sustainable Development Strategy.14