The opportunities of open wealth for the Swiss financial centre

The opportunities of a new Open Wealth industry standard for the Swiss financial centre

Wealth management is a cornerstone of the Swiss financial centre. Innovation in this industry is key to maintain the globally leading role and competitive advantage of Switzerland in this field, namely in cross-border wealth management. In concrete numbers: by the end of 2020, banks in Switzerland administered assets under management totalling CHF 7,878.7 bn. Furthermore, Switzerland accounts for a quarter of all cross-border assets under management worldwide.

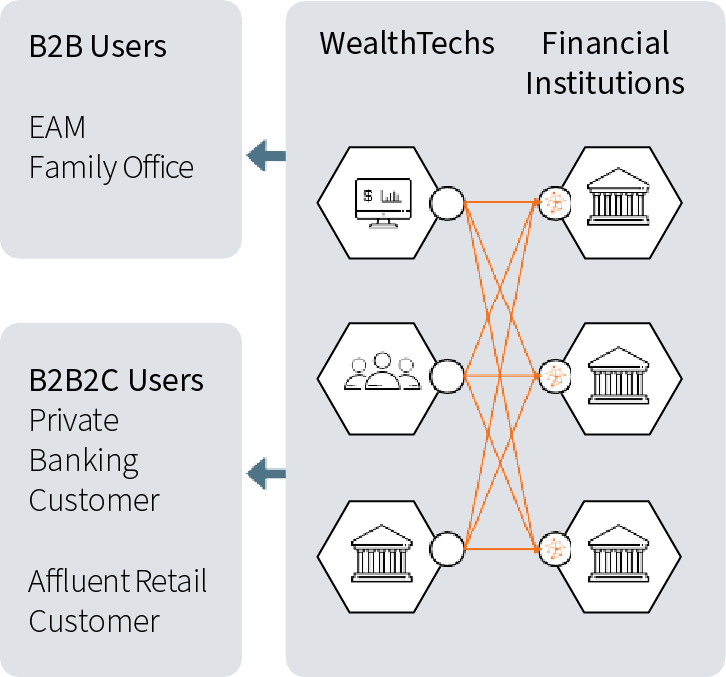

Other important players in the Swiss financial market are financial intermediaries such as family offices and the more than 2000 external asset managers (EAMs) and trustees. In general, an EAM is a wealth manager which works independently from banks and opens accounts at custodian banks on behalf of his clients, whereas the assets are held by the banks. Financial intermediaries use wealthtech software solutions like portfolio management systems (PMS) to manage the assets on behalf of their clients.

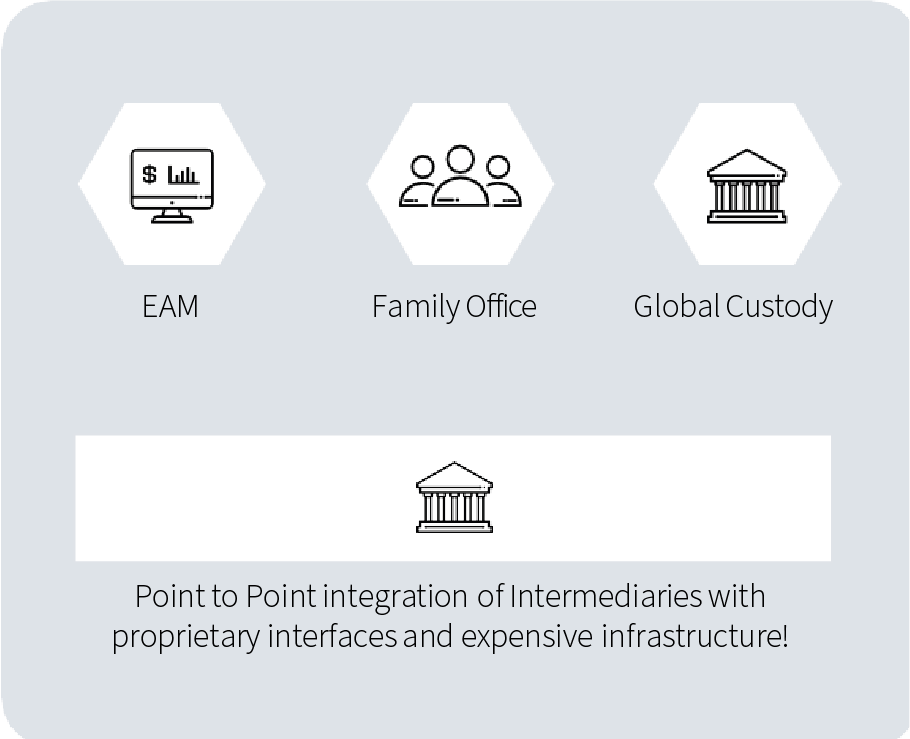

The current problem: Collaboration is hampered

An easy, safe, and secure collaboration between banks, EAMs, wealthtechs and other third-party providers is important to unlock and foster innovation potential in the Swiss wealth management industry. So far, this collaboration has been associated with a large administrative effort of EAMs due to manual reconciliation and cleansing of position and transaction data in their respective PMS in setting up as well as managing customer relationships. For custodian banks on the other hand, it’s labour intensive to set-up and maintain the individual connectivity to PMS and manually process stock exchange orders and client data.

Source: OpenWealth Association

The solution: Together, banks and portfolio management systems solve a central customer problem

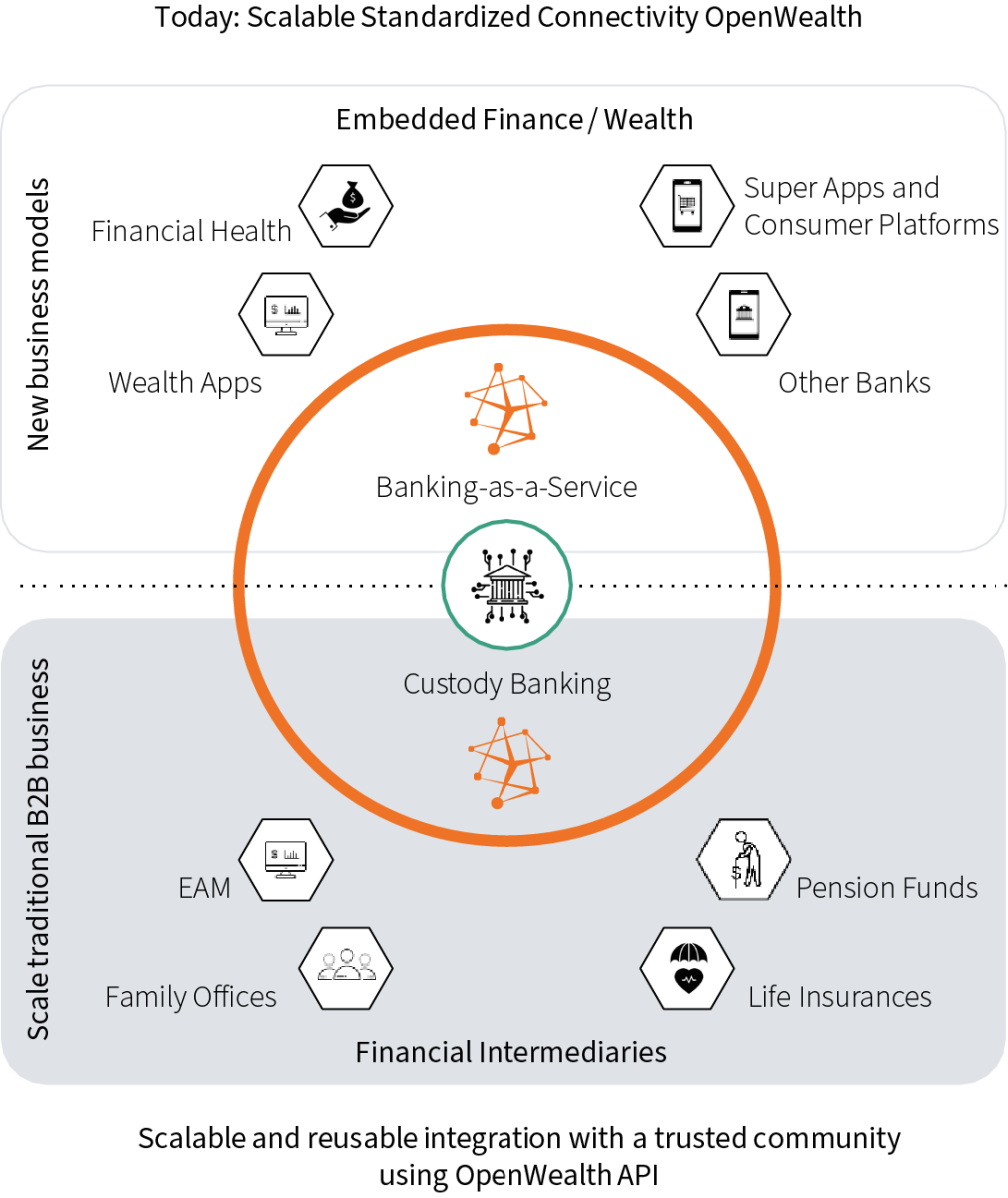

Open Wealth enables banks and financial intermediaries like EAMs and family offices to improve their collaboration capacities, thus offering even better services and a seamless customer experience. Through the implementation of openly available application programming interfaces (APIs), banks enable EAMs and other financial intermediaries to integrate position and transaction data into their PMS in a standardized and secure manner. Wealthtechs and other third-party providers can easily and securely dock onto the banks’ APIs and integrate the data directly into their software solution. The new data flow makes collaboration between all parties much more efficient. In addition, asset managers no longer must go through their e-banking to obtain the banks’ custody services, for example - a clear advantage in terms of user experience.

Source: OpenWealth Association

Source: OpenWealth Association

Implementation: Linking of custody accounts and portfolio management systems

The linking of custody accounts and PMS among the various players is realized via standardized APIs.

Currently, there are two generic implementation options in Switzerland to connect banks and third-party providers:

- Peer-to-Peer: Banks and third-party providers connect point-to-point by using the openly available APIs and standardized security and user consent procedure.

- Connection via a central platform: Banks and third-party providers connect via a central platform like bLink to facilitate the secure exchange of data and third party management.

To ensure the use of standardised APIs in the Swiss financial centre, the Swiss bankers association (SBA) and Swiss Fintech Innovations (SFTI) have agreed upon the roles each will play in future cooperation on Open Finance, together with the relevant players of the Swiss financial market. SFTI is acting as a central forum, drawing up the necessary business and technical principles and recommendations for Open Finance in Switzerland in conjunction with the leading national and international stakeholder groups and partner organisations. The SBA, for its part, is assuming a coordinating role in conveying the industry’s concerns to politicians, authorities, and other relevant stakeholders.

In the context of Open Wealth, the task for working out standardised and openly available APIs has been delegated to the newly established OpenWealth Association. As such, the goal of the OpenWealth Association is to define, maintain and operationalise the Open API standard for a global wealth management community. By connecting financial institutions, wealthtechs and other third-party providers, and by setting the Open API standard for a global wealth management community, it wants to strengthen Switzerland as a financial hub and centre for innovation. Furthermore, the association aims to foster the exchange of expertise among its members and with third parties, as well as to cooperate with organizations of similar nature in Switzerland and abroad.

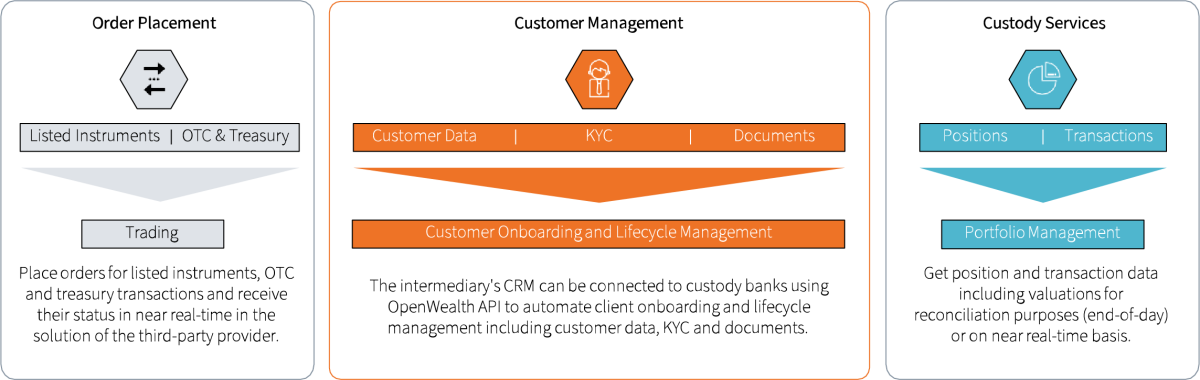

Currently, the OpenWealth API consists of three interfaces:

- OpenWealth Order Placement: In the application of the consumer of the interface, orders for securities can be placed with the custodian bank (service provider) and details on the order status can be queried.

- OpenWealth Customer Management API: Data requesters/consumers of the interface can retrieve customer master data pertaining to customer (contract) and personal data, addresses, contact information, as well as KYC information. The service user application (e.g. external asset managers) can onboard customers and maintain customer data like KYC, addresses and documents to support the full customer lifecycle at a custodian bank via API.

- OpenWealth Custody Service API: Data recipients/consumers of the interface are able to receive timely or end-of-day processed position and transaction data for their customers' accounts (custody accounts, cash accounts, etc.), e.g. for reconciliation purposes.

The currently published versions of the OpenWealth APIs can be explored on the API Sandbox of the OpenWealth Association: OpenWealth Association – API Sandbox

Source: OpenWealth Association

How does the linking a software solution to a custodian bank work in detail?

Application in the Swiss market

The community that is actively pursuing and promoting Open Wealth in Switzerland is steadily growing. A current list of all participating institutes can be found on here: OpenWealth Association - OpenWealth API Standard and Community.

Conclusion

The exchange of data through openly available APIs has the potential to radically change and improve the wealth management industry. The Swiss financial centre could maintain its position as a leading financial hub and innovation centre for wealth management by embracing the new opportunities arising from the broad adoption of OpenWealth. With the OpenWealth approach, financial institutions, wealthtechs and other service providers can connect via standardized and openly available APIs. As such, they jointly solve a key customer problem and set the ground for a global wealth management community.

Further information

Further information on OpenWealth and Open Finance in general can be found here:

OpenWealth Association - OpenWealth API Standard and Community

Swiss Fintech Innovations – Future of Financial Services

SwissBanking: Digitalisation, Innovation & Cybersecurity - Open Banking