AI in finance – an opportunity or a risk?

22.06.2023

Artificial intelligence (AI) is making great strides into the world of finance. Its use is no longer an exception, and AI already has a wide range of applications in the financial sector. Let us observe how the Swiss financial sector responds to this sweeping wind of change.

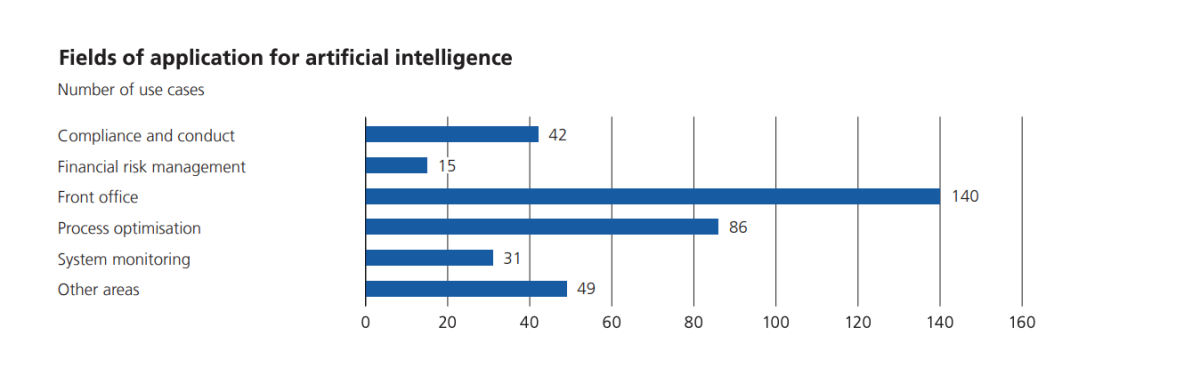

Around half of the financial institutions supervised by the Swiss Financial Market Supervisory Authority (FINMA) today use AI or have specific plans to do so, a survey carried out by the regulator in 2022 showed. AI-based applications are essentially deployed in their front offices and for process optimization purposes. Other areas of application include compliance and conduct, financial risk management, system monitoring and other areas such as translation.

Source: FINMA Annual Report 2022

Swiss finance sector also tests application of ChatGPT

The release of the AI chatbot ChatGPT in late November 2022 has also attracted attention among Swiss financial institutions. The global insurance company Zurich for example currently tests how it could be used for claims adjustments and modeling in its daily insurance business. Larger language models such as ChatGPT could potentially generate enormous efficiency gains, notably in the field of data extraction and coding for statistical models.

Emergence of a Swiss AI-powered fintech sector

Some Swiss financial institutions rely on their own IT when it comes to AI-powered solutions, but not exclusively. Most also use the AI applications developed or services provided by external companies. A myriad of fintechs tapping on this rapidly growing market have in recent years emerged in Switzerland.

Yverdon-based NetGuardians is one of them. This fintech helps financial institutions to fight fraud, with a 3D AI solution that prevents fraudulent payment in real time. DeepJudge is another good example. This start-up uses AI to analyze the content of legal documents. Its multilingual tool quickly processes thousands of earlier deals, contracts and clauses with a simple search. This for instance saves time when a lawyer easily can access previously written clauses in contract. The Zurich-based company hopes its exposure will help it to expand to the financial sector.

Pros and cons of AI in finance

As just mentioned, AI offers a wide range of opportunities for financial institutions. It processes far more data at speed that humans only can dream of and give precise search results and predictions in a matter of seconds. AI can also handle and provide a better insight into billions of data and help to financial institutions to develop tailored services for their clients. The technology can help to meet compliance, detect fraud and achieve a more precise risk assessment. Implementing AI reduces the need for human experts to do these tasks, resulting in lower personnel costs.

But as any other technology AI also entails risks, when applied without any human intervention. Studies have shown that there tends to be embedded bias encoded in AI, including ChatGPT, making their algorithms racist, sexist or ableist. Not ideal when taking decisions or tailoring financial services, as it can lead to unequal treatment of clients or employees. Data privacy is another risk. In April, the Swiss Federal Data Protection and Information Commissioner (FDIPC) warned that the processing of personal data by AI-supported tools such as ChatGPT entails risks to both privacy and self-determination. The widespread use of AI in finance could have unexpected impacts on financial stability, and there are other risks.

Swiss regulator isn’t a passive bystander

In the light of the increasing use of artificial intelligence (AI), the Swiss government and FINMA have not been idle. In February 2022, the Swiss Federal Council instructed the Swiss State Secretariat for International Finance SIF to prepare an overview of the legal framework conditions in the area of AI applications that are of relevance for the financial sector. As for FINMA, it established last year a specialist unit for artificial intelligence. The role of this new unit is to supervise the ongoing rollout of AI among Swiss financial institutions. The first set of supervisory expectations has already been issued. FINMA has increased information sharing with both domestic and foreign authorities, as well as experts as regards the latest developments in AI.

AI at the Point Zero Forum in Zurich

From 26-28 June, the Point Zero Forum in Zurich will also be dedicated to Artificial Intelligence in Finance. At a roundtable organised by the Swiss State Secretariat for International Finance SIF, experts from the authorities, industry and academia will discuss the ongoing market transformation and policy considerations on the second day of the Forum from 3 to 5 pm.

More information about this roundtable, including the full list of participants can on Point Zero Forum’s website here.